Six Mobile Banking Apps Tested for User Experience

Posted: 03/06/2020 | Author: Creatives On Call for Creatives On Call

Have you ever downloaded a mobile app, opened it once and never used it again? 1 out of 5 download an app and abandon it after one use, proving first impressions are everything in real life and the digital world.

Good user experience design of a mobile app can make or break a consumer's loyalty with a brand. In a study conducted by PWC, 1 out of 3 customers said they would leave a brand they love after just one bad experience. User experience (UX) is the complete interaction a user has with a company's products and services. Currently, only 55% of companies in general are conducting any UX testing.

We took a look at the banking industry to see how they are measuring up in the UX of their mobile apps. We put six mobile banking apps to the test to learn what’s working and what could be improved. Overall experience, security, accessibility, and the ease of navigation of each app were evaluated. We also noted what we liked and what could use some work.

96% of people surveyed said they use their bank's mobile app more than going to the branch location or ATM. Convenience was the number one reason given for using a mobile banking app. The top three uses of a mobile banking app included checking account balances, transferring funds between accounts, and mobile deposits.

Security in mobile banking is critical to the user experience. 89% of users surveyed felt their private information was safe in the app. Many reported that they trust their bank and sited two-factor authentication and not having had a prior issue, as reasons they felt their information was secure.

Here are how the mobile apps ranked in user experience:

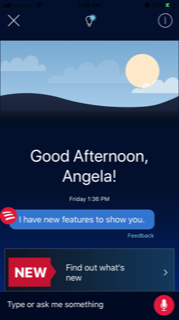

#1 Bank of America

We Liked: Bank of America's mobile app dashboard is easy to navigate and customizable. Bank of America has great security notifications for transactions, allowing the user to verify or decline right away. The app features Erica, a virtual financial assistant. Customers can also link their Merrill account to view investment information. Overall, the app has a clean design and includes an AI component, which is why Bank of America gets our highest rating.

Could be improved: The mobile bill pay set up, viewing and retrieving account numbers, and the mobile deposit function could be enhanced to make the app even better.

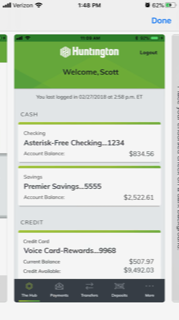

#2 Huntington

We Liked: Huntington's app received the mobile banking app satisfaction award for 2019 by the J.D. Power company. The app is intuitive to use. If the user wants to check account balances, they don't have to log in to the app. Security push notifications are easy to set up, too. Overall, Huntington's app receives high marks from customers and is nationally recognized.

Could be improved: Updates to the app and changes to the navigation can make it difficult to find what the user is looking for.

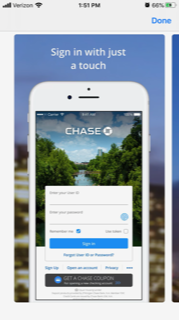

#3 Chase

We Liked: Chase's mobile app has nice images and has a lot of different functions. New features are highlighted frequently. Chase's app includes a feature where you can see your savings progression which helps with the motivation to keep saving! One thing that differentiates Chase's app is the ability to reload a liquid debit card within the app. The app is very secure with accessible customer service.

Could be improved: Transferring funds outside the app, viewing business and personal accounts on the same screen, bill pay, and adding chatbot customer service are some areas where the app could be improved.

#4 Fifth Third Bank

We Liked: The Fifth Third Bank mobile app is straight forward. The user can see a quick snapshot of account balances when they log in. The Now Balance® feature allows customers to check balances quickly by swiping left. Fifth Third's mobile deposit function makes it easy to deposit checks from anywhere and the check image is nice and clear on the screen.

Could be improved: The app menu, login, and the set-up of notification preferences. Helpful articles, budgeting tools, and a chat function could be added to improve the app's resources and customer service.

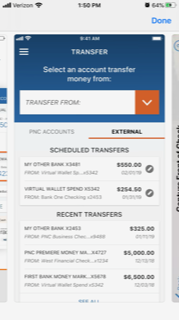

#5 PNC

We Liked: The PNC app is secure and offers a facial recognition function. PNC has a feature that can make transitioning to a virtual wallet a breeze. PNC allows customers to use the app for their credit and debit cards if they don't have their physical card accessible, where some banks will only allow this function for debit cards. And with voice and text banking the app is very accessible.

Could be improved: Users noted the speed and making the ability to search for past transactions easier in the app.

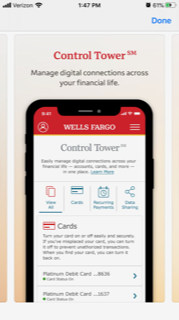

#6 Wells Fargo

We Liked: Users can achieve basic functions easily in the Wells Fargo app. The app is secure with the option to set up face or touch ID. The user can set up mobile bill pay and access it without logging in as well. The app has a good search function for typing in what the user needs and locating it. Wells Fargo's app allows the user to track investments in addition to checking and savings. Wells Fargo was named "Best Mobile App for Monitoring Investments" by Smart Asset.

Could be improved: Areas for improvement included, making account and routing numbers easier to find, and viewing bill totals on one screen. Customers also wish they could turn off service offers in the app.

Create a Better User Experience

Many mobile banking apps offer similar features and functions. Banks have the opportunity to stand out with the user experience they provide. There is an increased need for banks to innovate through on-demand technology such as AI, voice banking, and partnering with Fin Techs. If banks can provide a superior user experience, leveraging the latest technology, they will be able to compete in the changing landscape of digital banking.

Leverage Creatives On Call's user experience designers to increase customer loyalty with your brand today.

Bank of America Huntington Chase Fifth Third. PNC Wells Fargo